Investment Banking Bonuses Soar in 2024

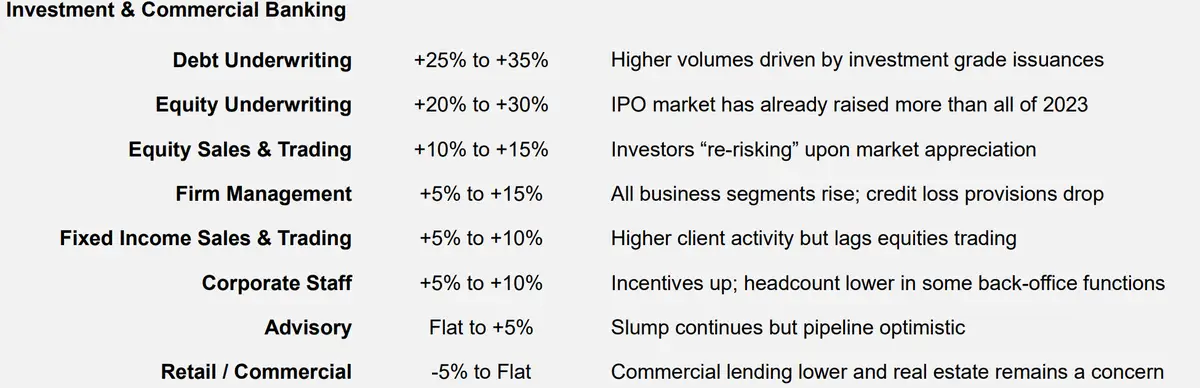

Investment bankers are set for a windfall in 2024, according to Johnson Associates, a top Wall Street compensation analysis firm. Here’s what to expect:

- Debt underwriting specialists: 25% to 35% bonus increase

- IPO handlers: 20% to 30% bonus boost

What’s Driving These Increases?

- Robust growth in debt issuance

- Surging IPO activity, already exceeding 2023’s total raised capital

- Growing market confidence

- Return to normalized business operations post-pandemic

Despite revenues still below peak levels, investment banking activity shows a significant upward trend.

Deep Dive: Debt Underwriting

The surge in debt underwriting bonuses can be attributed to:

- Increased corporate borrowing

- Companies taking advantage of relatively low interest rates

- Refinancing activities to optimize capital structures

- Growth in high-yield bond issuances

IPO Market Renaissance

The IPO market’s resurgence is fueled by:

- Tech startups finally going public after years of private funding

- SPACs (Special Purpose Acquisition Companies) creating new opportunities

- Improved investor sentiment towards new listings

- Pent-up demand from companies that delayed IPOs during uncertain times

Bonus Hikes Across Banking Sectors

The good news extends beyond investment banking:

- Equity traders: 10% to 15% bonus increase

- Fixed-income traders: 5% to 10% compensation boost

Why the Boost?

- Increased client risk tolerance in equities

- Expectations of future interest rate cuts

- Higher market volatility leading to more trading opportunities

Impact of Market Volatility

- Heightened volatility creates more alpha-generating opportunities

- Skilled traders who can navigate uncertain markets are highly valued

- Increased trading volumes contribute to higher revenues and bonuses

Alternative Investments: A Different Story

Alternative investment firms face unique challenges:

- Projected incentives: Flat to 10% higher

- Main reason: Large volumes of uninvested capital (dry powder)

Challenges in the Alternative Investment Space

- Increased competition for attractive deals

- High valuations making it difficult to deploy capital effectively

- Pressure to deliver returns in a low-yield environment

- Regulatory scrutiny impacting certain strategies

Wealth and Asset Management Outlook

Executives in these sectors can expect:

- 5% to 10% higher incentives

This steady growth highlights the ongoing importance of professional financial guidance.

Factors Driving Wealth and Asset Management Growth

- Aging population seeking retirement planning

- Increasing complexity of financial markets

- Growing interest in ESG (Environmental, Social, and Governance) investing

- Technological advancements enabling more personalized services

Key Factors Shaping 2024 Bonuses

Several elements contribute to the positive outlook:

- Economic Recovery: Global rebound sparking increased deal activity

- Low Interest Rates: Spurring borrowing and refinancing

- Pent-up Demand: Delayed deals and IPOs now moving forward

- Tech Advancements: Improved efficiency creating new opportunities

- Regulatory Changes: Impacting various sectors differently

The Role of Technology in Shaping Bonuses

Technology is playing an increasingly important role in financial services:

- AI and Machine Learning: Enhancing trading strategies and risk management

- Blockchain: Creating new opportunities in areas like decentralized finance (DeFi)

- Robotic Process Automation: Improving back-office efficiency

- Big Data Analytics: Enabling more informed investment decisions

These technological advancements are not only changing how financial services are delivered but also influencing compensation structures. Professionals who can effectively leverage these technologies are likely to see higher bonuses.

What This Means for Wall Street

The 2024 bonus forecast signals a strong year ahead:

- Increased competition for top talent

- Potential shifts in job market dynamics

- Greater emphasis on performance-based compensation

Looking Ahead

While the outlook is positive, it’s important to note:

- Projections may change based on global economic conditions

- Regulatory shifts could impact bonus structures

- Unforeseen market events may alter the landscape

Preparing for the Future

Financial professionals should focus on:

- Continuous skill development, especially in emerging technologies

- Staying informed about regulatory changes

- Building a diverse skill set to remain valuable in a changing market

- Cultivating strong client relationships

Regional Variations in Bonus Trends

It’s worth noting that bonus trends may vary by region:

- New York: Traditionally the highest bonuses, expected to lead in 2024

- London: Despite Brexit challenges, still competitive, especially in fintech

- Hong Kong and Singapore: Strong growth expected, driven by Asian market expansion

- Frankfurt and Paris: Potential beneficiaries of post-Brexit financial services shifts

Conclusion

The 2024 Wall Street bonus forecast paints an optimistic picture for finance professionals. As the industry evolves, those who adapt and excel in this dynamic environment stand to benefit the most.

Key takeaways:

- Investment banking leads the bonus surge

- Trading bonuses benefit from market volatility

- Alternative investments face unique challenges

- Technology continues to reshape the financial landscape

- Regional differences may impact bonus structures

Stay tuned for updates!

Image Credit: Johnson Associates