Financial institutions across Wall Street are preparing for potential staffing adjustments as ongoing economic uncertainty threatens to prolong the current dealmaking slowdown.

Deal Slowdown Impacts Revenue

U.S. investment banks may soon implement more job cuts if economic uncertainty continues to hamper dealmaking in the coming months. The warning signs are already appearing in the numbers – global investment banking fees dropped 6.3% to $16.83 billion in the first quarter compared to $17.96 billion during the same period last year. The decline is even more dramatic when compared to the fourth quarter of 2024, when fees reached $19.96 billion as dealmaking had shown signs of rebounding.

Banks Already Taking Action

Several major Wall Street institutions have already started their annual staff reductions targeting underperforming employees. JPMorgan and Bank of America have begun these cuts, while Goldman Sachs and Morgan Stanley are planning to lay off staff in the coming weeks.

Boutiques Hit Hardest

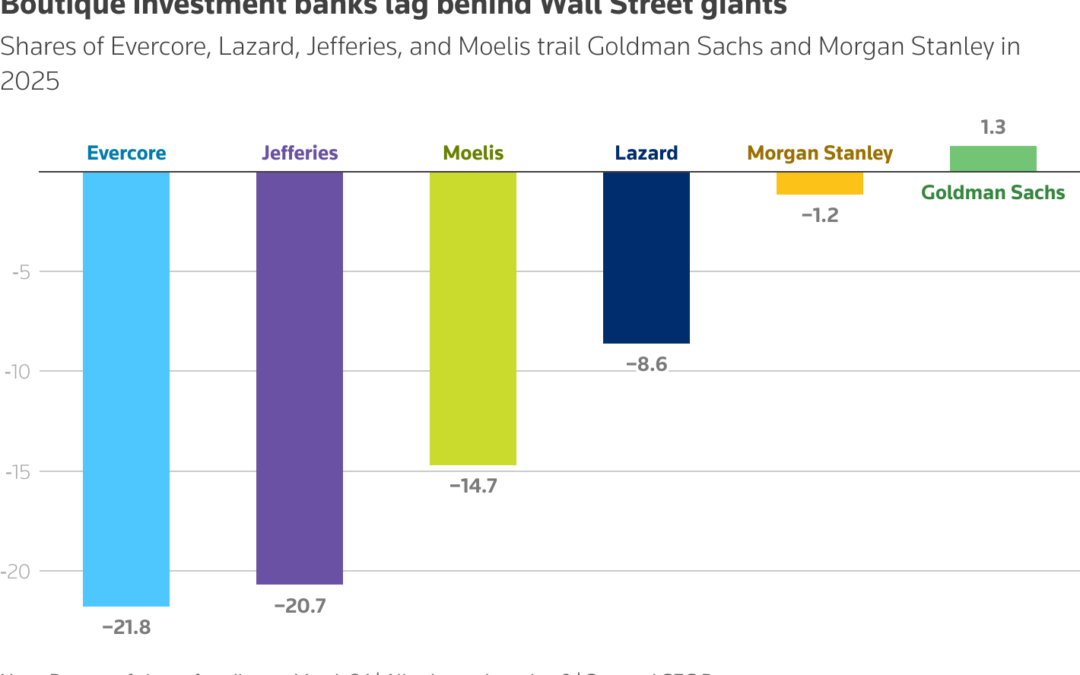

The uncertain outlook has particularly punished smaller investment banks. Shares of boutique firms have taken the biggest hit, with Evercore’s stock falling about 22% year-to-date and Jefferies down 21% so far this year. In contrast, diversified megabanks have shown more resilience – JPMorgan shares are up 3.5% and Goldman Sachs has risen 1.3% during the same period.

Bonus Implications

While bonuses at Wall Street institutions increased last year as activity rebounded—with Bank of America’s investment banker bonus pool rising an average of 10% for 2024—analysts suggest these compensation packages could be at risk for 2025 if current conditions persist.

Areas of Opportunity

Despite the overall challenging environment, there are still growth opportunities in specific sectors such as private credit and technology. However, consumer, industrial, and building and construction sectors face potential slowdown.

Bottom Line

The financial services industry faces a critical few months ahead. If deal activity doesn’t recover soon, we could see more significant staffing adjustments across Wall Street as firms adjust to the new economic reality.

What are your thoughts on how the financial sector should navigate these uncertain times? Share in the comments below!

Source: Reuters article “Wall Street job cuts loom as market turmoil stalls deals” by Saeed Azhar, March 26, 2025